Surging demand in China for the upkeep of advanced Nvidia graphics processors—despite Washington’s export ban—has spawned a small but lucrative repair ecosystem in Shenzhen. Roughly a dozen boutique workshops now advertise the ability to troubleshoot and revive H100 and A100 accelerators. These have entered the country through gray-market channels, according to industry insiders, who told Reuters.

The market exists only because the hardware is scarce and irreplaceable. The United States blocked sales of the H100 to China in September 2022 and simultaneously barred its predecessor, the A100. U.S. officials argued that cutting-edge GPUs could accelerate military AI research. Although Nvidia subsequently created scaled-down H20 silicon that complies with restrictions, Chinese research labs and cloud providers still covet the more powerful H100. They seek it for training large language models.

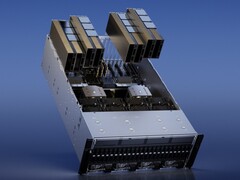

Keeping those chips online is becoming critical. Many have been running flat-out in data center racks for years. As a result, failure rates are on the rise. Typical lifespans of two to five years mean that power-delivery circuits, high-bandwidth memory packages, and even cooling fans need periodic attention. One long-standing graphics-card specialist said it spun off a dedicated subsidiary in late 2024. The specialist now refurbishes as many as 500 AI GPUs every month, validating each fix in a 256-node server room. This setup mimics customer clusters.

Pricing reflects both scarcity and complexity. Shops quote between CN¥10,000 and CN¥20,000 (about $1,400–2,800) per card. This equals roughly 10 percent of the unit’s original value, for jobs ranging from solder-reflow work to HBM replacement. A comparable eight-way H20 server officially costs well over CN¥1 million (≈ $139,000). Traders say a B200-equipped chassis can fetch more than CN¥3 million (≈ $418,000).

Washington’s concerns go beyond smuggling. Bipartisan bills introduced this year would mandate post-sale location tracking for high-end accelerators, in an effort to stem illicit flows. Nvidia, for its part, says only the company and authorized partners can provide full technical support. The company warns that operating restricted products without firmware and software updates is “a non-starter”. Yet, business in Shenzhen remains brisk. For now, China’s AI players still see value in keeping contraband silicon humming—regardless of the geopolitical headwinds.

Source(s)

Reuters (in English)